India's Top 500 Companies 2016 |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

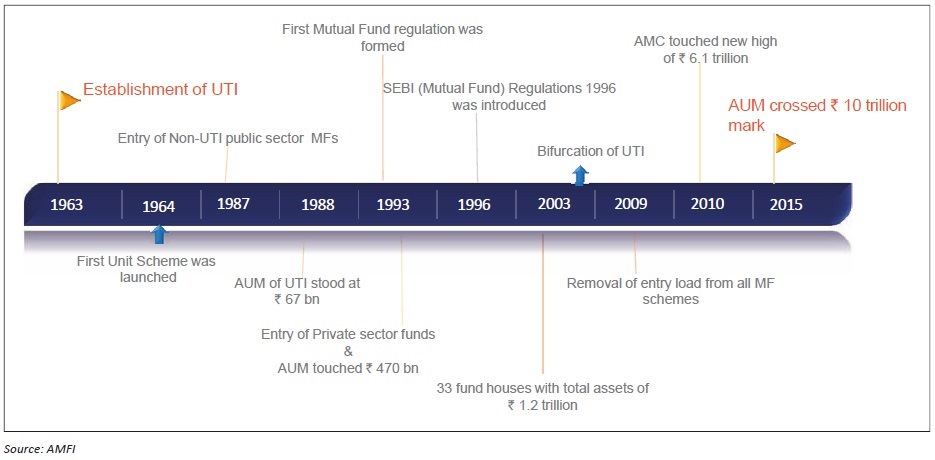

1. Genesis & Development of Mutual Fund sector in India

Mutual Funds have emerged as a popular investment vehicle

in the last decade. The industry has seen several phases of

transformation since 1963, when Unit Trust of India (UTI)

was established under the aegis of Government of India

(GoI) and Reserve Bank of India (RBI). The phase between

the years 1987-1993, marked the entry of several non-UTI

public sector mutual fund companies like Life Insurance

Corporation of India (LIC), General Insurance Corporation

of India (GIC), SBI Mutual Fund, Punjab National Bank

Mutual Fund and Indian Bank Mutual Fund among others.

In 1993, private players entered the mutual fund space.

Post 2003, the mutual fund sector entered an era of growth

and consolidation, with bifurcation of UTI into two separate

entities. There were also several mergers among the private

sector funds. Between the years 2009-13, the industry

witnessed subdued growth owing to volatility across

domestic and international bourses. In Mar 2009, AUM fell

nearly 18% to  4.2 tn from

4.2 tn from  5 tn in Mar 2008.

5 tn in Mar 2008.

Since 2013, the industry has not just shown signs of recovery

but has gained unprecedented momentum crossing the

10 tn benchmark during Mar 2015.

10 tn benchmark during Mar 2015.

2. Performance of Mutual Funds In India

Mutual Funds surpass  10 trillion AUM mark; aim at

closing FY16 strong

10 trillion AUM mark; aim at

closing FY16 strong

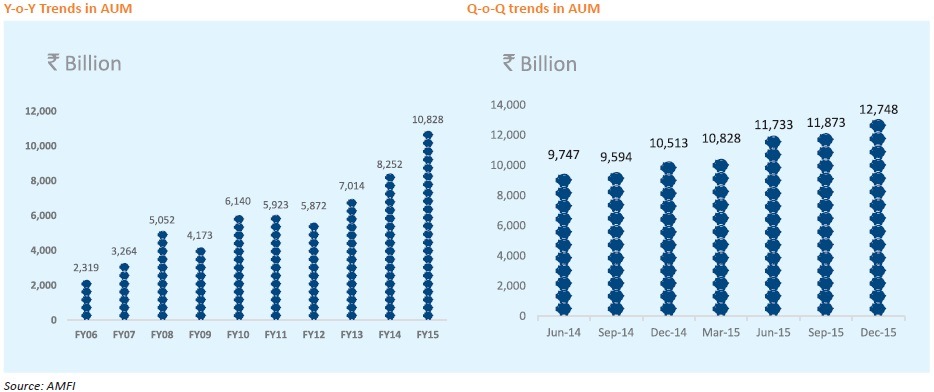

The year 2015 has been an unprecedented year in the

history of mutual funds in India. The asset base of mutual

fund industry surged nearly  3 tn in FY15, crossing the

3 tn in FY15, crossing the  10

tn benchmark. The countryís fund houses together saw a

growth of 33.2% in AUM to end the year FY15 at

10

tn benchmark. The countryís fund houses together saw a

growth of 33.2% in AUM to end the year FY15 at  10.8 tn.

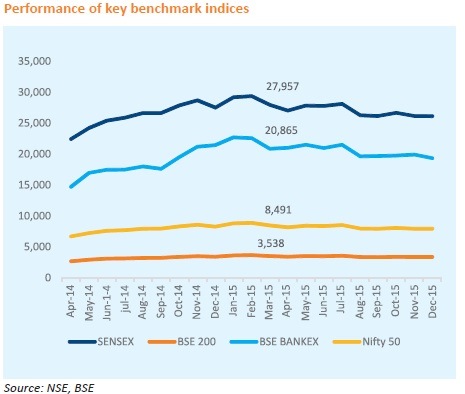

Key benchmark indices including the BSE Sensex and Nifty

50 expanded nearly 25% and 27% during the year. Robust

inflows in the market mainly led by domestic investors

continued to be in favour of the mutual fund sector. The

first three quarters of FY16 witnessed AUM reaching almost

10.8 tn.

Key benchmark indices including the BSE Sensex and Nifty

50 expanded nearly 25% and 27% during the year. Robust

inflows in the market mainly led by domestic investors

continued to be in favour of the mutual fund sector. The

first three quarters of FY16 witnessed AUM reaching almost

13 tn, showcasing a strong growth of 21.3% in Dec 2015

as compared to Dec-14.

13 tn, showcasing a strong growth of 21.3% in Dec 2015

as compared to Dec-14.

This was the fastest growth registered by the industry, after a four year slag period that started in FY09 and dented the AUM growth momentum till FY12. The industry bounced back in FY13 with 19.3% growth in AUM. Since then, the industry has been looking forward to achieve new highs, weathering the impact of financial crisis and emerging as the preferred investment choice for investors.

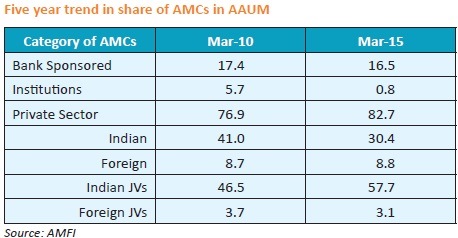

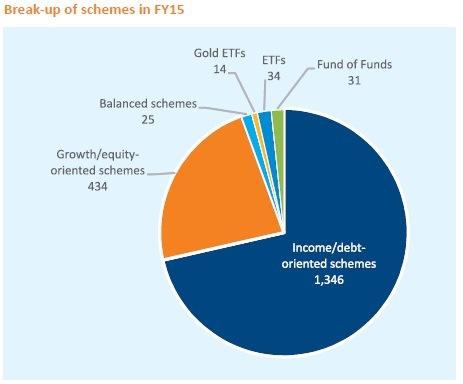

Private AMCs drive growth, gain inflows of rupees one trillion

As on Mar 31 2015, the mutual fund industry comprised of 44 Asset Management Companies (AMCs), including private sector entities, joint ventures (both Indian & foreign) and banks sponsored companies among others. The number of schemes offered by these entities grew from 1,638 in FY14 to 1,884 in FY15.

Amongst the institutions, private sector AMCs have a lionís

share of more than 80% in AAUM, mainly driven by Indian

JVs that accounted for more than 55% of the private sectorís

AAUM in Mar 2015. While the share of private sector AMCs

grew from 77% in FY10 to 83% in FY15, share of institutional

AMCs have reduced to negligible levels in FY15. On a y-o-y

basis, the private sector witnessed a net inflow of  1,037

bn in FY15. On the other hand, public sector mutual funds

accounted for net outflows of

1,037

bn in FY15. On the other hand, public sector mutual funds

accounted for net outflows of  4.1 bn during the same

period. Moreover, top 5 AMCs in the sector account for

more than 55% of the overall AAUM in FY15.

4.1 bn during the same

period. Moreover, top 5 AMCs in the sector account for

more than 55% of the overall AAUM in FY15.

Gilt and balanced funds gain appeal investors

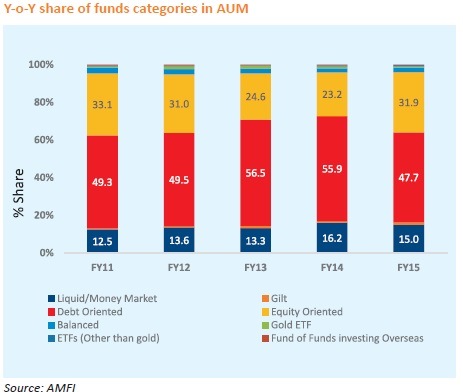

The equity and debt oriented funds continue to dominate the overall investments in mutual fund sector. The AUM across these two categories registered a CAGR of 15% each between FY11-FY15. On a y-o-y basis, AUM of equity mutual funds bounced back strongly with 80% growth in FY15 as compared to 11% growth achieved in FY14. This was mainly on account of HNI accounts in equity oriented schemes that grew by 95% and HNI investments that grew nearly twice as compared to previous year.

Gilt funds too, made a strong come back in FY15, owing to lending rate cuts announced by RBI towards the end of the year. On CAGR basis, AUM of gilt funds grew the fastest at 42.9% between FY12-FY15. Balanced funds also gained traction and registered growth of more than 55% over the previous year, clearly indicating rising preference for balanced funds that offer an ideal mix of investment in equities and debt.

HNIs: A game changer

The establishment of new government at the centre, falling crude prices and lending rate cuts led to improvement in economic conditions and revived market sentiments. The mutual fund industry added 2.2 mn new investor accounts in FY15 compared to previous year. Trend seen in erosion of accounts till FY14 reversed in FY15 with 5.5% growth seen in total accounts. This was further accelerated till the end of Dec 2015 with total accounts hitting a new high of 45.8 mn accounts.

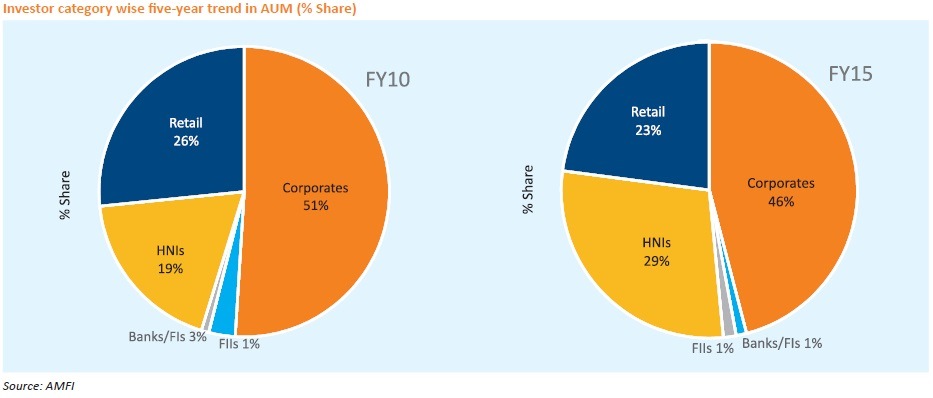

While retail participation continues to dominate investor

accounts across all the mutual fund types, the HNI segment

has significantly increased its participation in the last five

years across categories. The HNI folio count has recorded

a CAGR of 17% in the last five years; while the AUM of HNI

category has expanded at a CAGR of 22% during the same

period. The HNI share in AUM has escalated from 19%

in FY10 to 29% in FY15, showcasing an incremental HNI

investment of  2 tn in the last five years.

2 tn in the last five years.

The corporate sector accounts for a lionís share in mutual

fund assets, having invested  1.8 tn in overall AUM since

FY10. While the share of corporate folios across fund

categories is not noticeable, their share in AUM remains

dominant.

1.8 tn in overall AUM since

FY10. While the share of corporate folios across fund

categories is not noticeable, their share in AUM remains

dominant.

On the other hand, share of retail investors shrank both

in terms of number of folios and AUM. Retail investors

added  846 bn in the last five years; while the number of

retail accounts registered de-growth of 3% (CAGR basis)

between FY10-FY15. This trend however reversed in the

first three quarters of FY16, with retail folios reaching 43.7

mn accounts by Dec 2015, recording a 3% growth over the

previous quarter.

846 bn in the last five years; while the number of

retail accounts registered de-growth of 3% (CAGR basis)

between FY10-FY15. This trend however reversed in the

first three quarters of FY16, with retail folios reaching 43.7

mn accounts by Dec 2015, recording a 3% growth over the

previous quarter.

3. Technology Ė A Key Growth Enabler

The Indian economy has grown enormously in the last decade; however inclusive growth continues to be one of the biggest challenge.

Financial inclusion aims at extending the scope of banking activities to the unbanked population of the country. For achieving an inclusive macroeconomic growth, it is imperative to drive participation from all sections of the society towards financial instruments. The banking sector has overtaken securities market segments in terms of digitisation, payments and processes. It is crucial for other stakeholders to take cues from the banking sector and replicate the digital mode of operation. The mutual fund sector is poised to play a key role in achieving financial inclusion by leveraging technology and educating investors.

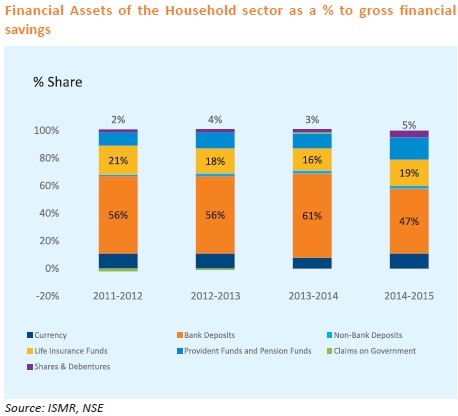

Lacklustre household participation needs a boost

The household sector which accounts for more than 55% (2013-14) of the gross savings, is one of the crucial investor category. However, more than 80% of these household savings are predominantly invested in fixed income securities such as bank deposits, PPFs and other such debt instruments. Shares and debentures account for a meagre 5% of the gross financial savings of the household sector which represents a huge untapped potential for the securities market. In the last few years however, the share of equities in household savings has improved from 2% in 2011-12 to 5% in 2014-15. It is extremely crucial to bridge this savings-investment gap for the growth and development of the mutual fund industry.

Mutual Funds riding on the social media wave

In a bid to spread awareness about mutual funds, fund houses are increasingly exploring the social media route. Micro blogging sites and social portals are emerging as an important channel of investor communication which is not only cost effective but has a wider appeal. Top fund houses in the country are already creating a dialogue with investors by posting news, fund launches, dividend declarations, job postings, notices and information on websites like Facebook and Twitter, thereby spreading financial awareness. However, adoption of such digital marketing initiatives are still restricted majorly to some of the top mutual fund players. It is imperative for all stakeholders of the mutual fund value chain; right from AMCs to distributors to have a social media strategy in place.

Reaching out to the untapped population

The mutual fund sector is also focused on exploring opportunities in several Tier-2 and Tier 3 cities of the country. The top 5 cities specifically, metros, still account for more than 70% share in AUM. The trend is showing a gradual shift from metros to smaller cities like Ahmedabad, Lucknow, Pune, Hyderabad, Chandigarh, Jaipur, Surat, Kanpur and Gurgaon among others. As per AMFI, assets from B15 (locations beyond Top 15) locations grew at 15.5% in Jan 2016 as compared to Jan 2015. Moreover, these locations had a better mix of equity and non-equity assets as compared to T15 (Top 15 locations) locations. A wide universe of highly cautious investors represent huge potential for the sector. Investor education campaigns aimed at showcasing mutual fund schemes as a safe and responsible investment. Moreover, a universal KYC enables mutual fund companies to extend its offerings to rural customers in association with regional banks and financial institutions. Even local post offices can be accounted as mutual fund distribution centres which will enable reaching out to the remotest area of the nation.

Harnessing technologies

The mutual fund sector has entered into a phase of transformation where itís not just launching innovative products but also making investment process easier. Most companies are aiming at reducing paperwork and channelizing the time and effort in reaching out to a wider set of investors. The motive lies in making the investment process easier and faster. Role of technology in this process cannot be undermined. E-commerce today plays a key role in our day-to-day lives, and the mutual fund industry is set to make the investing experience easier and user friendly. SEBI is already considering proposals to allow sale of mutual funds on e-commerce platforms. Furthermore, with rapid adoption of smartphones in India, the mutual fund industry is set to emerge as fore runners in driving financial inclusion. Business Intelligence and analytics (BI&A) also plays a crucial role in reaching out to the right customer with the right communication. Analytical tools are crucial for creating strategies for specific segment and geographies.

MF Utilities

MF Utilities (MFU) is a shared services initiative launched by the AMCs of SEBI registered mutual fund under the aegis of AMFI. The MF Utilities portal acts as a Transaction Aggregating System for transactions in mutual funds. This is one such initiative towards digitization of transactions in the sector. Under this scheme, the distributor logs into the MFU system and operates a single form to submit client transactions to any one registrar and transfer agent (RTA) unlike earlier, where different forms were required for different RTAs. This aims at reducing the cost and time of distributors that are registered with MFU.

4. The Road Ahead

Performance of mutual funds in the near future is directly linked to the performance of securities market. However, it remains to be seen how mutual fund companies strategize on tapping the untapped opportunities in remote India. With a large chunk of Indiaís population still residing in rural areas, productive deployment of their savings to mutual funds and offering low-risk instruments with steady returns remains a challenge for mutual fund players.

Moreover, technology being a key growth driver is to be harnessed to the fullest. The business strategy of AMCs should be designed towards innovating and simplifying Mobile Apps, websites, user-friendly platforms and secure transactions.