Optimism for Q1'24 remains elevated as businesses thrive on expectations for order and profits

The Dun & Bradstreet Business Optimism index records an increase of 3.6% (q-o-q) in Q1 2024

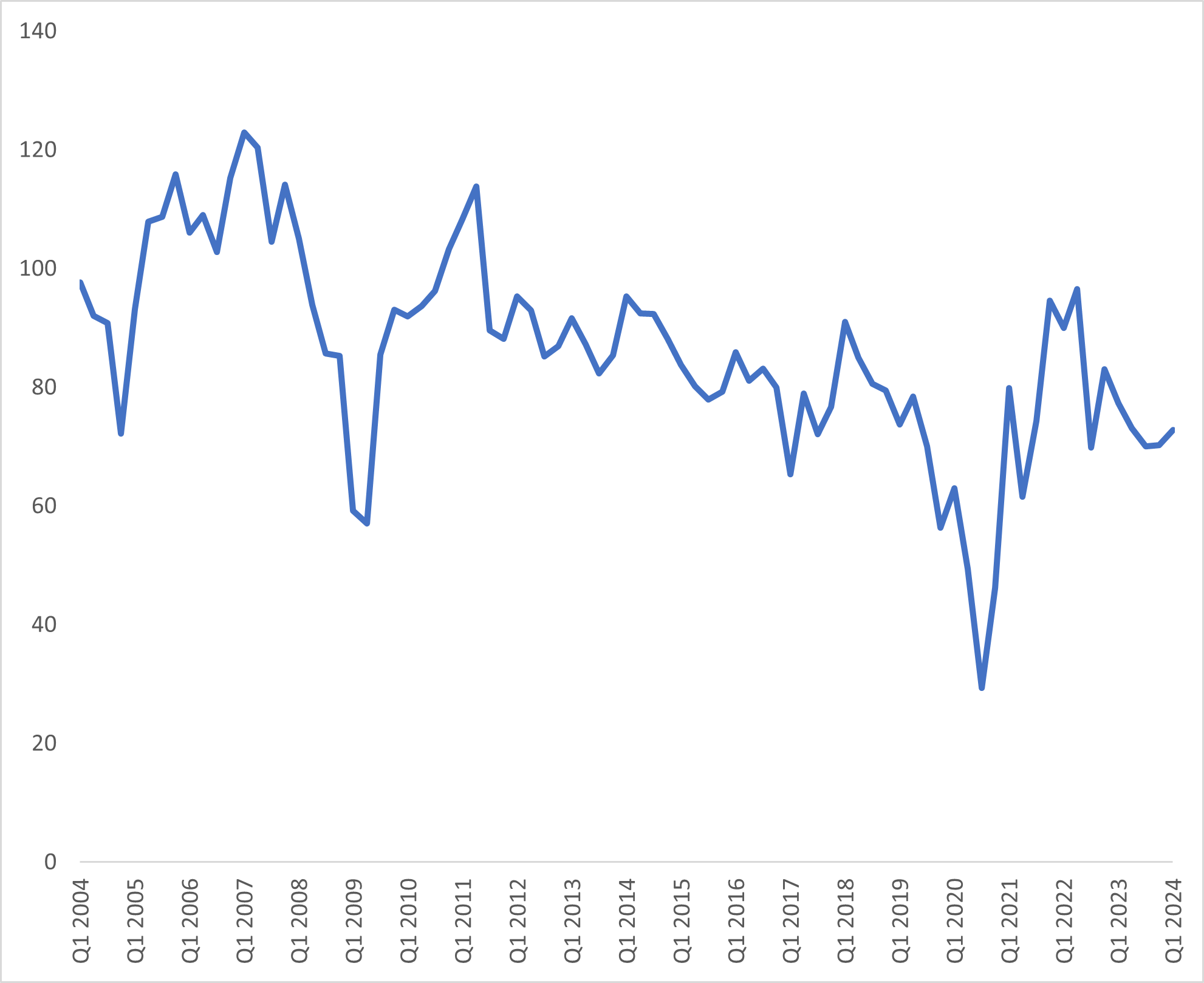

Mumbai, February 7, 2024: The Dun & Bradstreet Composite Business Optimism Index stands at 72.8 for Q1 2024, 3.6% higher compared to Q4 2023. Five out of six optimism indices have shown improvement while optimism for fresh hiring remains at the ten-quarter low. The Dun & Bradstreet Composite Business Optimism Index, which has been measuring the changing business sentiment of India Inc. since 2002, is a leading indicator for India’s overall growth, with a correlation co-efficient of around 80% with the Gross Domestic Product (GDP).

Highlights

- Optimism for increase in net profits stands at five – quarter high.

- Optimism for increase in selling prices has also improved by one percentage point against previous quarter.

- However, the optimism for fresh hiring of employees continues to be at the same levels seen in previous quarter and lowest since Q4 2021.

- While overall optimism among small firms has declined marginally by 0.2%, the optimism for medium and large firms have recorded growth of 5.2% and 3.1% respectively in Q1 2024, over the previous quarter.

- Highest growth in optimism for increase in net profits were witnessed in Automobiles industry.

- Electricals, electronics and hardware industries have experienced the steepest decline in optimism for inventory levels on a quarterly basis.

Dun & Bradstreet's Composite Business Optimism Index: Q1 2004 – Q1 2024

Note: BOI Index is for new base (2011)

Arun Singh, Global Chief Economist, Dun & Bradstreet said, “

India shines as a stable force amid global economic shifts, with a notable 3.6 percentage points rise in optimism level among businesses for Q1 2024. Despite a post-festive season dip in demand, the outlook for margin expansion remains strong, buoyed by the potential of lower global commodity prices. India's robust capital expenditure cycle, fueled by a vibrant government and private sector collaboration, fueled by ample credit, propels optimism for medium and large enterprises. In the face of global uncertainties and supply chain challenges, India's growth story stands resilient, showcasing the nation's unwavering commitment to progress on the global economic stage.

Key findings from the Q1 2024 survey

The optimism for increase in volume of sales has improved by 4 percentage points in Q1 2024, compared to previous quarter. Real Estate activities have recorded the highest growth, while the mining sector has recorded the lowest growth in optimism regarding increase in volume of sales on quarterly basis.

The optimism for increase in net profits has improved by 5 percentage points in Q1 2024, compared to Q4 2023. Automobiles industry has recorded the highest growth, while manufacturing of metals has recorded the lowest growth in optimism with respect to increase in net profits on quarterly basis.

The optimism for increase in selling prices has improved by 1 percentage point on quarterly basis in Q1 2024. The transportation and storage industries have recorded the highest growth, while automobiles industry has recorded the lowest growth in optimism regarding increase in level of selling prices compared to previous quarter.

The optimism for increase in new orders has improved by 7 percentage points in Q1 2024, compared to Q4 2023. the textiles industry has recorded the highest growth, while wholesale and retail trade have recorded the lowest growth in optimism regarding the expansion of order books on quarterly basis.

The optimism for inventory levels has moved up by 6 percentage points in Q1 2024, compared to Q4 2023. The manufacturing of automobiles has recorded the highest growth, while the electricals, electronics and hardware industries have recorded the lowest growth in optimism regarding inventory levels on quarterly basis.

The optimism for hiring of employees is stagnant in Q1 2024 with no change recorded compared to previous quarter. Chemicals, rubber and plastics industries have recorded the highest growth, while the manufacturing of food, beverages and tobacco has recorded the lowest growth in optimism regarding the fresh hiring of employees, compared to previous quarter.