India's Top 500 Companies 2016 |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Key Highlights

India accounted for about 2% of the world’s life insurance premiums as on 2014.

India is ranked 11th among 88 countries in life insurance business and 20th in global non-life insurance markets in 2014.

The life insurance segment dominates the Indian insurance sector with a share of around 79% in the total premium during 2014.

India’s insurance density stood at US$ 55 and insurance penetration stood at 3.3% in 2014

Premium Income of life insurance industry grew 4.4%

to  3,281 bn in FY15

3,281 bn in FY15

Life insurance industry witnessed 36.6% decline in the new policies issued in FY15

Direct selling continues to be the major distribution channels adopted by the insurance companies.

Individual agents and direct selling were the two major distribution channels for public sector which together accounted for over 95% of aggregate premium in FY15. For private sector players, corporate agents are the major distribution channel which contributed 38.3% to the new business.

Gross Direct Premium Income of non-life insurance

industry grew 9.2% to  846.8 bn in FY15

846.8 bn in FY15

In FY15, the public sector insurers exhibited growth of 10.2% while the private general insurers registered growth of 9.6% in premium underwritten.

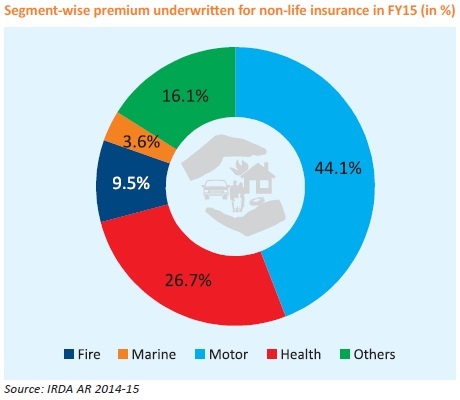

Motor insurance continue to be the largest noninsurance segment with the share of 44.1% in total non-life insurance premium underwritten.

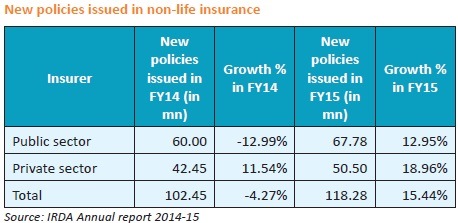

Non-life insurance industry witnessed 15.4% increase in the new policies issued in FY15

In FY15, GoI launched two insurance schemes viz. personal accident insurance scheme namely Pradhan Mantri Suraksha Bima Yojana (PMSBY) and government’s Life Insurance Scheme namely Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY).

IRDA has formulated a draft regulation, IRDAI (Obligations of Insures to Rural and Social Sectors) Regulations, 2015 to impose obligations on insurers towards providing insurance cover to the rural and economically weaker sections of the population.

India currently accounts for less than 1.5% of the world’s total insurance premiums and about 2% of the world’s life insurance premiums. In terms of premium volume, the country is the fifteenth largest insurance market in the world. During Mar-Sep 2015, foreign direct investment in the insurance sector stood at US$ 341 mn displaying a stupendous growth of 152% compared to the same period last year.

In 2014, India ranked 11th and 20th globally in life insurance and general insurance respectively

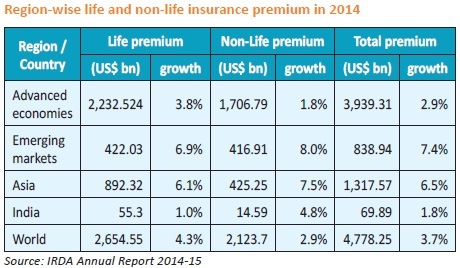

As per the ‘World Insurance in 2014’ report published by Swiss Re, the economic environment for insurers improved marginally in 2014, as global real GDP rose by 2.7%, near the 10-year annual growth rate average of 2.8%. The global total direct premiums written grew by 3.7% in 2014 to US$ 4,778 bn after a year of stagnation in 2013.

In 2014, the global life insurance premiums written stood at US$ 2,655 bn, up 4.3% after a decline of 1.8% in 2013 while the Indian life insurance premium stood at US$ 55.3 bn registering a growth of mere 1% in 2014. The recovery in the non-life insurance sector continued in 2014 with global premiums up 2.9% to US$ 2,124 bn. The emerging markets were the main drivers for the global non-life premium growth. There was slightly slower but still robust 8% growth in emerging market premiums. The Indian nonlife insurance segment performed better in 2014 with the premium growing at 4.8% to US$ 14.6 bn against the world average growth of 2.9%.

The Indian insurance sector has developed and evolved significantly over the past decade and ranked 11th among 88 countries in life insurance business and 20th in global non-life insurance markets in 2014. However, share of the Indian insurance market in the global insurance market is small. Further, it ranks low in terms of insurance penetration and density, the two important indicators that show the development of the insurance sector in any country. During 2014, India’s share in global life insurance market was 2.6, while its share in the non-life insurance premium was a mere 0.7%.

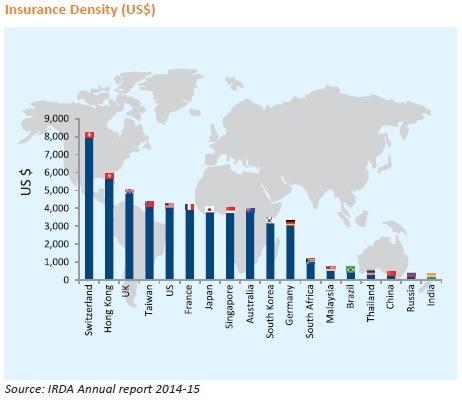

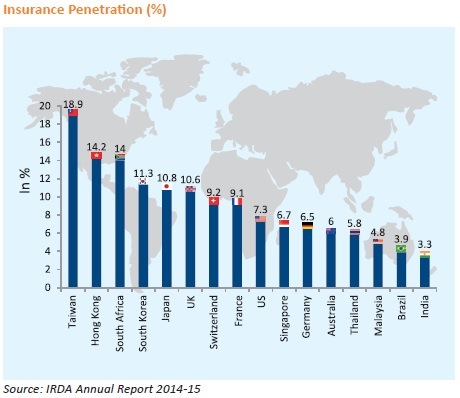

Insurance penetration refers to premium as a percentage of GDP whereas insurance density refers to per capita premium or premium per person. India’s insurance density stood at US$ 55 in 2014, way behind the world average of US$ 662.

The level of insurance penetration depends on a large number of factors like level of economic development of the country, the extent of the savings in financial instruments and the size and reach of the insurance sector. The world average in insurance penetration stood at 6.2% in 2014 and India is way behind at 3.3%. The life insurance segment has fared well with a penetration level of 2.6% in 2014 compared with a world average of 3.4%. However, the increase in nonlife insurance sector has been marginal with a penetration level of 0.7% compared with world average of 2.7%. Some of the major factors responsible for lower penetration of insurance products in India are low income levels, low consumer preference, untapped rural markets, claimsettlement time and constrained distribution channels.

Globally, the life insurance segment leads in terms of insurance premium with a share of 55.6% and the non-life insurance segment accounting for the balance. Similarly, in India, the life insurance segment dominates the sector with a share of around 79% in the total premium paid. Tax incentives provided in return for investment in insurance contribute heavily to the high share of life insurance premium.

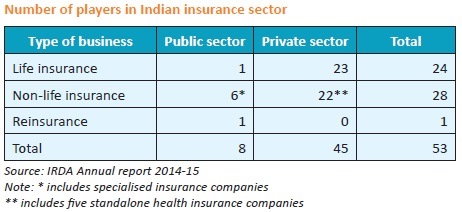

Public sector dominates the Indian insurance industry

Currently the Indian insurance industry comprises 53 companies, of which 28 are operating in the non-life insurance business, 24 in the life insurance segment, and a lone national re-insurer. Of the 24 life insurance companies presently in operation, 23 are in the private sector and one in the public sector. Indian non-life insurance industry comprise of 22 private sector companies and six public sector companies including two specialised insurers.

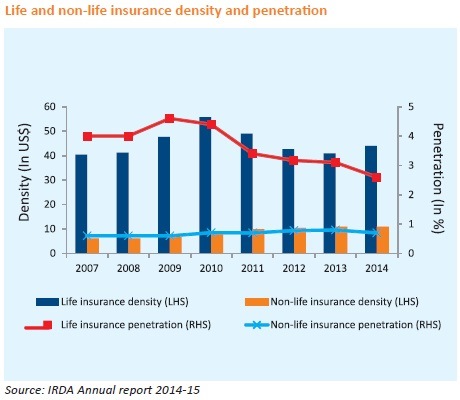

Penetration and density of life insurance segment in the country continues to be higher than non-life segment

The measure of insurance penetration and density reflects the level of development of insurance sector in a country. After liberalization, the sector has reported consistent increase in insurance penetration from 2.71% in 2001 to 5.2% in 2009. However, since then, the level of penetration has been declining reaching 3.3% in 2014. A similar trend was observed in the level of insurance density which reached the maximum of US$ 64.4 in 2010 from the level of US$ 11.5 in 2001 but followed a declining trend to stand at US$ 55 in 2014.

The insurance density of life insurance business had gone up from US$ 9.1 in 2001 to reach the peak at US$ 55.7 in 2010. Between 2010 and 2013, density followed a declining trend but registered a marginal increase to US$ 44 in 2014. Similarly, the life insurance penetration surged from 2.15% in 2001 to 4.6% in 2009. Since then, it has exhibited a declining trend reaching 2.6% in 2014. Over the last 10 years, the penetration of non-life insurance sector has gone up from 0.56% to 0.7% while its density has gone up from US$ 2.4 in 2001 to US$ 11.0 in 2014.

Life insurance industry

Public sector continues to dominate the Indian life insurance segment with 73% market share in spite of less number of players.

Premium Income of life insurance industry grew 4.4% in FY15

Life insurance industry recorded a premium income of

3,281 bn in FY15 as against

3,281 bn in FY15 as against  3,143 bn in FY14, registering growth of 4.4%. While private sector insurers posted a

considerable growth of 14.3% in their premium income, LIC

recorded a mere 1.2% growth in premium income in FY15.

Around 65.5% of the total premium received by life insurers

was contributed by renewal premium while the remaining

34.5% was contributed by first year premium in FY15. During

the year, the renewal premium grew at 10.7% while first year

premium registered a decline of 5.8%.

3,143 bn in FY14, registering growth of 4.4%. While private sector insurers posted a

considerable growth of 14.3% in their premium income, LIC

recorded a mere 1.2% growth in premium income in FY15.

Around 65.5% of the total premium received by life insurers

was contributed by renewal premium while the remaining

34.5% was contributed by first year premium in FY15. During

the year, the renewal premium grew at 10.7% while first year

premium registered a decline of 5.8%.

Unit-linked products (ULIPs) registered a growth of 10.85% in

premium from  3,75.4 bn in FY14 to

3,75.4 bn in FY14 to  416.2 bn in FY15. On

the other hand, premium from traditional products grew at

3.5% to

416.2 bn in FY15. On

the other hand, premium from traditional products grew at

3.5% to  2,864.8 bn from

2,864.8 bn from  2,767.6 bn in FY14. Accordingly,

the share of ULIPs in total premium increased to 12.7% in

FY15 from 11.9% in FY14. However, over a period of five

years, the share of ULIPs in total premium has gone down

drastically from 37.4% in FY11.

2,767.6 bn in FY14. Accordingly,

the share of ULIPs in total premium increased to 12.7% in

FY15 from 11.9% in FY14. However, over a period of five

years, the share of ULIPs in total premium has gone down

drastically from 37.4% in FY11.

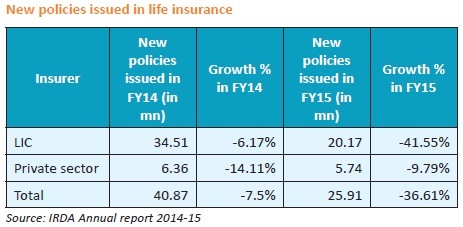

Life insurance industry witnessed 36.6% decline in the new policies issued

In FY15, life insurers issued 25.9 mn new policies, out of which LIC accounted for 77.9% of total new policies issued and the private life insurers accounted for the rest 22.1% of total new policies issued. Overall, the industry witnessed a 36.6% decline in the number of new policies issued. While the private sector registered a decline of 9.8% per cent, LIC registered a significant decline of 41.6% in the number of new policies issued in FY15.

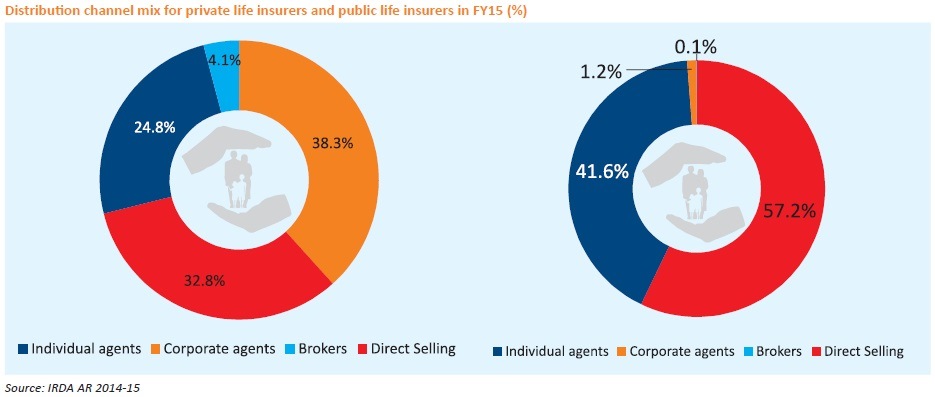

Direct selling continues to be the major distribution channel for life insurance products

With the increase in competition, new categories of distribution channels like corporate agents, insurance brokers, web-aggregators and insurance marketing firms have been allowed to carry out insurance distribution activities. In FY15, Direct Selling had contributed 49.67% of the total new business of life insurance compared to 47.84% in FY14. The share of individual agents to the aggregate premium had decreased to 36.44% from 40.64% in FY14. The contributions made by banks and corporate Agents other than banks were 11.34% and 1.26% respectively. The brokers contributed 1.28% to the aggregate premium in FY15.

Individual agents and direct selling were the two major distribution channels for public sector which together accounted for over 95% of aggregate premium in FY15. For private sector players, corporate agents are the major distribution channel which contributed 38.3% to the new business.

In FY15 for the public sector’s individual new business, individual agents (95.9%) were the major distribution channel while for private sector’s individual new business corporate agents (50.7%) were the major contributor. For group business, direct selling continues to be the dominant channel of distribution for group business, with a share of 97.5% of premium of public sector and 76.6% of premium of private sector in FY15.

The year FY15 witnessed a decline of 5.6% in the number of individual agents from 2.2 mn as on Mar 31 2014 to 2.07 mn as on Mar 31 2015. Number of corporate agents also declined from 689 as on Mar 31 2014 to 503 as on Mar 31 2015. The Insurance Broking is steadily popularizing and the number of insurance brokers registered stood at 419 comprising of 365 direct brokers, 47 composite brokers and seven reinsurance brokers as on Mar 31 2015.

General Insurance industry

The general insurance industry in India is growing at a

healthy rate of 17% and currently earning around  780 bn

premium p.a.. The non-life insurance sector is dominated

by public sector companies with the public companies

accounting for 56.2% of the market share in FY15.

780 bn

premium p.a.. The non-life insurance sector is dominated

by public sector companies with the public companies

accounting for 56.2% of the market share in FY15.

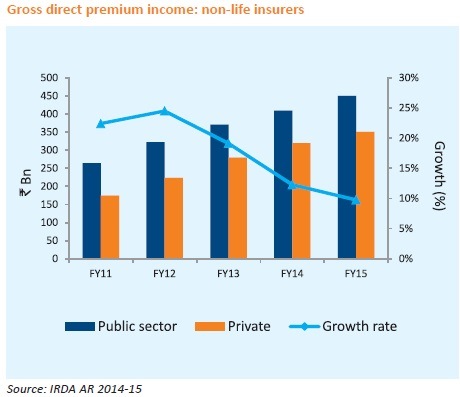

Gross Direct Premium Income of non-life insurance industry grew 9.2% in FY15

Over the past five years ending FY15, gross direct premium

income of non-life insurers has grown at a 5-year CAGR of

17.5%. In FY15, the non-life insurance industry underwrote total premium of  846.8 bn in India as against

846.8 bn in India as against  775.5 bn

in FY14 registering a growth of 9.2% as against an increase

of 12.1% recorded in the previous year.

775.5 bn

in FY14 registering a growth of 9.2% as against an increase

of 12.1% recorded in the previous year.

Premium income of private sector and public sector insurers

grew at 5-year CAGR of 20.2% and 15.6% respectively during

this period. In FY15, the public sector insurers exhibited

growth of 10.2% while the private general insurers registered

growth of 9.6% in premium underwritten. The premium

underwritten by private sector insurers including standalone

health insurers in FY15 stood at  380.3 bn as against

380.3 bn as against

342.6 bn in FY14.

342.6 bn in FY14.

The public sector insurers also underwrite non-life insurance

business outside India. The total premium underwritten

outside the country by the public sector insurers stood at

24.7 bn in FY15 registering a growth of 3.6% against 16.1%

growth in the previous year. The premium underwritten

outside India accounted for 2.8% of total premium

underwritten by the non-life insurers.

24.7 bn in FY15 registering a growth of 3.6% against 16.1%

growth in the previous year. The premium underwritten

outside India accounted for 2.8% of total premium

underwritten by the non-life insurers.

Increasing awareness of compulsory motor third party liability insurance, rising health concerns leading to increased demand for health insurance, rising demand for property insurance are some of the important factors which can be attributed for the healthy performance of non-life insurance industry in FY15. Although the growth is healthy, there is immense scope for the sector for further growth and insurers must consider factors such as appropriate pricing, product innovation and speedy to cover the untapped market.

In the general insurance segment, motor insurance continue

to be the largest non-insurance segment with the share of

44.1% in total non-life insurance premium underwritten. The

motor insurance segment reported growth rate of 10.5% in

FY15 as compared to 14.2% in FY14. Health insurance is the

second largest non-insurance segment constituting 26.7%

of the segment premium in FY15. The premium collection

in health segment continued to surge ahead at  226.4

bn in FY15 from

226.4

bn in FY15 from  196.3 bn in FY14, registering growth of

15.3%.

196.3 bn in FY14, registering growth of

15.3%.

Non-life insurance industry witnessed 15.4% increase in the new policies issued

In FY15, non-life insurers issued 118.28 mn new policies, out of which public sector accounted for 57.3% of total new policies issued and the private life insurers accounted for the rest 42.7% of total new policies issued. Overall, the industry witnessed a 15.4% increase in the number of new policies issued. Both private sector and public sector reported an increase of 18.9% and 12.9% in the number of new policies issued, thus underwritten 50.5 mn and 67.78 mn new policies in FY15.

Regulatory initiatives

The GoI has taken a number of initiatives to boost the insurance industry. Some of them are as follows:

15 bn

which is mandatory under the Civil Liability for Nuclear

Damage Act to offset financial burden of foreign nuclear

suppliers.

15 bn

which is mandatory under the Civil Liability for Nuclear

Damage Act to offset financial burden of foreign nuclear

suppliers.E-commerce in Insurance sector

E-commerce has changed the way business is conducted across the world. The ease and convenience to buying a product online has revolutionised the manner in which products are sold across the world. A plethora of products are being sold and delivered using the electronic platform to millions of customer in India.

To increase insurance penetration and to bring financial inclusion in a cost-effective manner in the insurance industry, IRDA is inclined to facilitate the promotion of e-commerce in insurance space which will lower the cost of transacting insurance business and bring higher efficiencies and greater reach. Therefore two groups, one for life insurance and the other for general insurance has been formed consisting of experts from regulatory body, insurers, intermediaries, insurance repositories, etc. to explore opportunities and suggest the way forward to promote e-commerce in the insurance sector.

The groups will identify opportunities, recommend technological solutions, and suggest regulatory and other facilitation measures for the growth of e-commerce in insurance sector.

Conclusion

India’s life insurance sector is amongst the biggest in the world with about 360 mn policies. Over the next five years, the number of policies is expected to increase at a CAGR of 12-15%. The insurance industry aims to hike penetration levels to 5% by 2020 and is anticipated to quadruple in size over the next 10 years from its current size of US$ 60 bn. During this period, the life insurance market is slated to cross US$ 160 bn. India’s insurable population is anticipated to touch 750 mn in 2020, with life expectancy reaching 74 years. Furthermore, by 2020 life insurance is projected to comprise 35% of total savings as against 26% in 2010.

With several changes in regulatory framework which leads to change in the way the industry conducts its business and engages with its customers, insurance sector stands to benefit. Rising of the FDI limit in the sector is expected to result in surge of capital inflow into the sector. Demographic factors such as growing middle class, young insurable population and growing awareness of the need for protection and retirement planning are expected to aid the growth of Indian life insurance.