Impact of COVID-19 on Business and Technology & Risk Mitigation Strategies for CIOs

02-Apr-20

The period of uncertainty (after the economic shock or fear of occurrence of the event), rather than the occurrence of the event itself, can have a substantial impact on various economic variables by altering the decision-making behaviour of individuals at a macro or a micro level. The economic shock here refers to any economic policy (monetary or fiscal), regulation changes, any decision taken by the Central Bank, policymakers or government or any unexpected economic development etc. Though there has been significant research on the impact of uncertainty on economic variables earlier, it was not until the recent financial crisis, that it began to be widely researched and quantified. Several research papers have provided evidence on how increased uncertainty has played a noticeable impact on real activity in various countries. This is of particular importance to policymakers. For any policy decision to be effective, it becomes relevant that the potential benefits are rightfully understood by the group of individuals for whom the policy is designed for or the nation. Any uncertainty caused by the news of a policy decision might make it difficult to implement effectively and/or negate the positive outcomes to a certain extent. A case in example is the recent demonetisation and the implementation of Goods and Services Tax (GST) which created huge uncertainty and impacted the Indian economy.

It has been well documented about how uncertainty, regarding the financial crises, have impacted the growth path of various countries globally including India. For example, uncertainty explained part of the collapse in global economic activity in 2008 -2009 (Stock and Watson (2012)) and of the sluggish ensuing economic recovery (IMF (2013)).

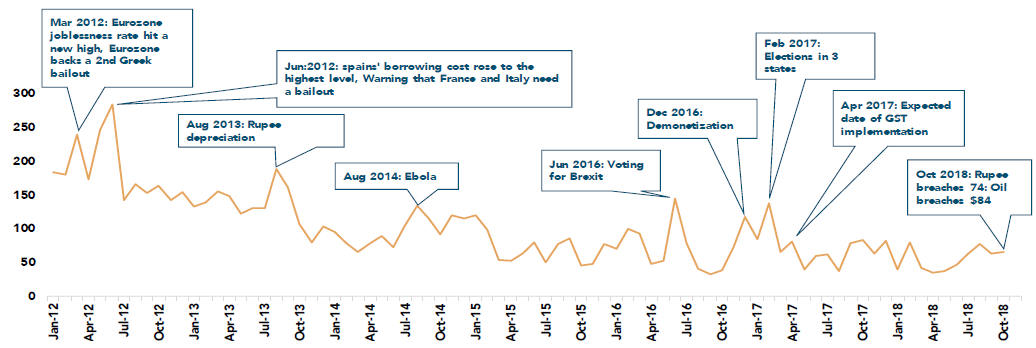

In this article, we have tried to examine that during the period 2012 to 2018 (till September 2018), whether uncertainty has played any role in influencing the movement of the multiple economic variables. We looked at the impact of economic policy uncertainty (EPU) shocks on the Indian macroeconomic variables such as Index of industrial production (IIP), retail inflation, short-term money market rates, the stock market, rupee and imports using Impulse Response Function (IRF). As a measure of uncertainty, we have considered the EPU index developed by Baker. Baker et al. (2013) have developed a news-based economic policy related uncertainty index for major economies around the world, including India. The above graph plots the uncertainty index and the various shocks that impacted the economy during this period.

It was found that the duration of the response in industrial production against the uncertainty shock lasted for approximately eight months before returning to the long-term equilibrium level. Uncertainty caused significant changes in the initial few months and a large impact in the 3rd month. An impulse in uncertainty at time zero had a very negligible impact on retail inflation or CPI; it impacted most between the 1st and the 2nd month, however, the effects of the shock completely dissipated around the 4th month. It has also been found that uncertainty explained only 0.67% of the variation in CPI in the 1st month. An impulse in uncertainty on 91- Days Treasury Bills at time zero had a maximum negative impact in the 2nd month and became positive in the 4th month but started to taper off from the 4th month. Interestingly, for the stock market, an impulse in uncertainty at time zero had a maximum positive impact in the 2nd month which then started to taper off from the 4th month. One standard deviation shock in uncertainty causes a significant change in rupee for three consecutive periods and it took seven months for the rupee to return to its equilibrium level. Further, a one standard deviation shock in uncertainty caused a significant impact on imports during the first month and the impact of the shock lasted for six months before returning to equilibrium.

Dun & Bradstreet, the leading global provider of B2B data, insights and AI-driven platforms, helps organizations around the world grow and thrive. Dun & Bradstreet’s Data Cloud, which comprises of 455M+ records, fuels solutions and delivers insights that empower customers to grow revenue, increase margins, build stronger relationships, and help stay compliant – even in changing times.

Gain your stakeholders confidence for increased business opportunities and establish your brand credibility.

Industry-leading data and analytics, integrated into a powerful AI-driven credit management platform