By Dr. Arun Singh,

Global Chief Economist,

Dun & Bradstreet

14thSeptember 2022

Droughts and Heatwaves Add to Supply-Chain Issues

Commentary:

“Droughts in parts of Europe, Mainland China and the US have upset inland navigation, hydroelectric power generation and agricultural output, adding to pre-existing supply chain strains; in addition to this, energy insecurity in Europe makes a stagflationary scenario most likely in this part of the world. In India, although downside risks to growth now remain skewed, we expect the upcoming festive season to support growth unless global slowdown intensifies and spillover effects strengthens, especially upon the export growth prospects”.. ” said Dr Arun Singh, Global Chief Economist, Dun & Bradstreet.

Introduction

While central banks around the world are fighting inflation, droughts and heatwaves have further complicated their work. Through the summer months, large parts of the world, especially in the Northern hemisphere, were in the grips of severe droughts and heatwaves. These long spells of droughts - some of the worst on record - choked inland waterways from the Yangtse in Mainland China to the Rhine in Germany, upset hydroelectric power generation, and hurt agriculture output. This forced transporters to operate with lower cargo loads, increased reliance on coal for energy, and further pressurised food and agricultural commodity prices. Droughts are not a new phenomenon, but the ability of countries to deal with them at this scale and intensity remains untested. Together, these will prolong the supply-chain strains in the near term and, in turn, alter business decisions in the medium term.

At the first in-person convention held at Jackson Hole in three years, central bankers delivered a clear message: inflation remains top priority. But this means different things for different economies. In the US, the Fed’s choice is straightforward. It will not slow down the pace of its rate hikes, notwithstanding the jobs report that followed the meeting. The latest US labour market reports show a marginal uptick in the rate of unemployment (to 3.7% from 3.5%), but even at these levels, it remains historically low. And given the economy is still adding jobs at a healthy pace, it reduces the pressure off the Fed to pull back on its rate hikes. In Japan, the BOJ is unlikely to move on rates yet, as it still considers sustained inflation an unfinished business. In the euro area, the ECB must make the painful choice of turning hawkish at a time where the probability of a recession in the block has risen. Separately, Mainland China delivered another rate cut to bolster its economy as domestic and external headwinds to its economic growth have intensified.

European policymakers are grappling with potentially the most severe challenge. Russia’s decision to halt gas supplies - first for three days, and then altogether - has added concerns that the European block may be staring at tight gas supplies through the winter. Business may have to find alternate suppliers, turn back to ‘dirty’ fuels to meet energy shortfalls, make a hasty transition to green energy, or cut back production. These are all costly choices and come with their own set of risks. Also, unlike the U.S., inflation has not shown signs of peaking yet. At the macro level, it means the likelihood of a stagflationary scenario is the highest in this part of the world.

GLOBAL OUTLOOK: THE OUTLOOK ON THE MIDDLE EAST REGION HAS BEEN UPGRADED TO ‘STABLE’ FROM ‘DETERIORATING’

The Middle East region offers some reason for optimism. As per reports, there are increasing signs that a nuclear deal between Iran, the EU and the US is nearing a positive conclusion. This would be a welcome change for crude importers, as it could bring Iranian oil to market. Meanwhile, countries such as Saudi Arabia and the UAE continue to benefit from their strong oil revenues and elevated geopolitical profiles. Businesses could align themselves with the long-term diversification strategy and aim to benefit from a positive near-term growth outlook in these economies. The risk to watch would be signs of regional hostilities as a nuclear deal would not necessarily allay security concerns of US allies such as Israel.

Separately, parts of Asia, particularly Vietnam and India, also offer growth opportunities. It is worth highlighting that the Asia-Pacific region is entering a period of political and security volatility. Domestic politics in Australia, Malaysia, Thailand and Pakistan have witnessed a series of dramatic events involving high-profile political leaders. At the same time, heightened rhetoric and military manoeuvres rooted in Sino-US competition affects countries torn between the two giants, given their divergent economic and security interests. For business this means an urgent assessment of supply routes, and enhanced monitoring on the security and compliance front.

|

Dun & Bradstreet Country Risk Analysis |

|||

|

Country |

August 2022 |

September 2022 |

Change |

|

Country Risk Rating Upgrades (risk level has improved) |

|||

|

Turkmenistan |

DB6c |

DB6b |

1 Quartile |

|

Country Risk Rating Downgrades (risk level has deteriorated) |

|||

|

Germany |

DB2d |

DB3a |

1 Quartile |

|

Outlook Trend Upgrades (from/to) |

|||

|

None |

|

|

|

|

Outlook Trend Downgrades (from/to) |

|||

|

None |

|

|

|

REGIONAL SUMMARIES

North America

The latest jobs report and a marginal uptick in unemployment is unlikely to deter the Fed from its rate-hike path, a commitment reinforced in the Jackson Hole convention of central bankers. Housing market weakness, especially in Canada, could hurt consumer spending.

Western and Central Europe

Western Europe’s regional outlook is retained as ‘deteriorating rapidly’. European countries increase efforts to shore up gas supplies at a moment when droughts across the continent add pressure to already elevated electricity prices, further squeezing incomes and intensifying recession fears. More interest rate hikes are likely.

The Nordics

Despite structural strength in the Nordics economies - strong government finances and still robust demand – the outlook is mired in the negative spillover of the Russia-Ukraine crisis. High commodity fueled inflation, which the central banks are trying to manage through monetary tightening, and sluggish consumer demand have increased recessionary pressures.

Asia Pacific

Business prospects remain weak amidst inflationary pressures and weakening growth. Tensions between US and Mainland China, and on the Korean peninsula, continue to simmer. Growth concerns in Mainland China have prompted another rate cut. Political events unfolding in Malaysia, Thailand, Australia and Pakistan, warrant attention.

Latin America & Caribbean

Growth outlook appears to be modest given meagre growth in formal employment, declining investments and tightening monetary policy. While tourism recovery shows signs of improvement, it remains considerably below pre-pandemic levels. As energy and food prices continue to climb, a crisis in the cost of living exacerbates domestic difficulties.

Eastern Europe & Central Asia

The Russia-Ukraine war continues to fuel high economic uncertainty and severe business disruptions. Russia, Ukraine and Belarus remain in the grips of a severe economic downturn. For other economies, high energy and commodity prices remain key risks.

Middle East & North Africa

The outlook for the region has moved to ‘stable’ from ‘deteriorating’. Positive progress on the Iran nuclear deal has raised expectations that Iranian oil could come on to the global market, partly helping to ease energy prices. Most GCC countries continue to perform well with good business prospects, particularly in Saudi Arabia and the UAE.

Sub-Saharan Africa

Rising inflationary pressures in sub-Saharan Africa, especially for fuel and food items, would increase political instability risk in the region. Angola’s closely contested elections indicate that unemployment, cost of living, and corruption could pose a challenge for ruling parties across the continent.

Dun & Bradstreet Risk Indicator

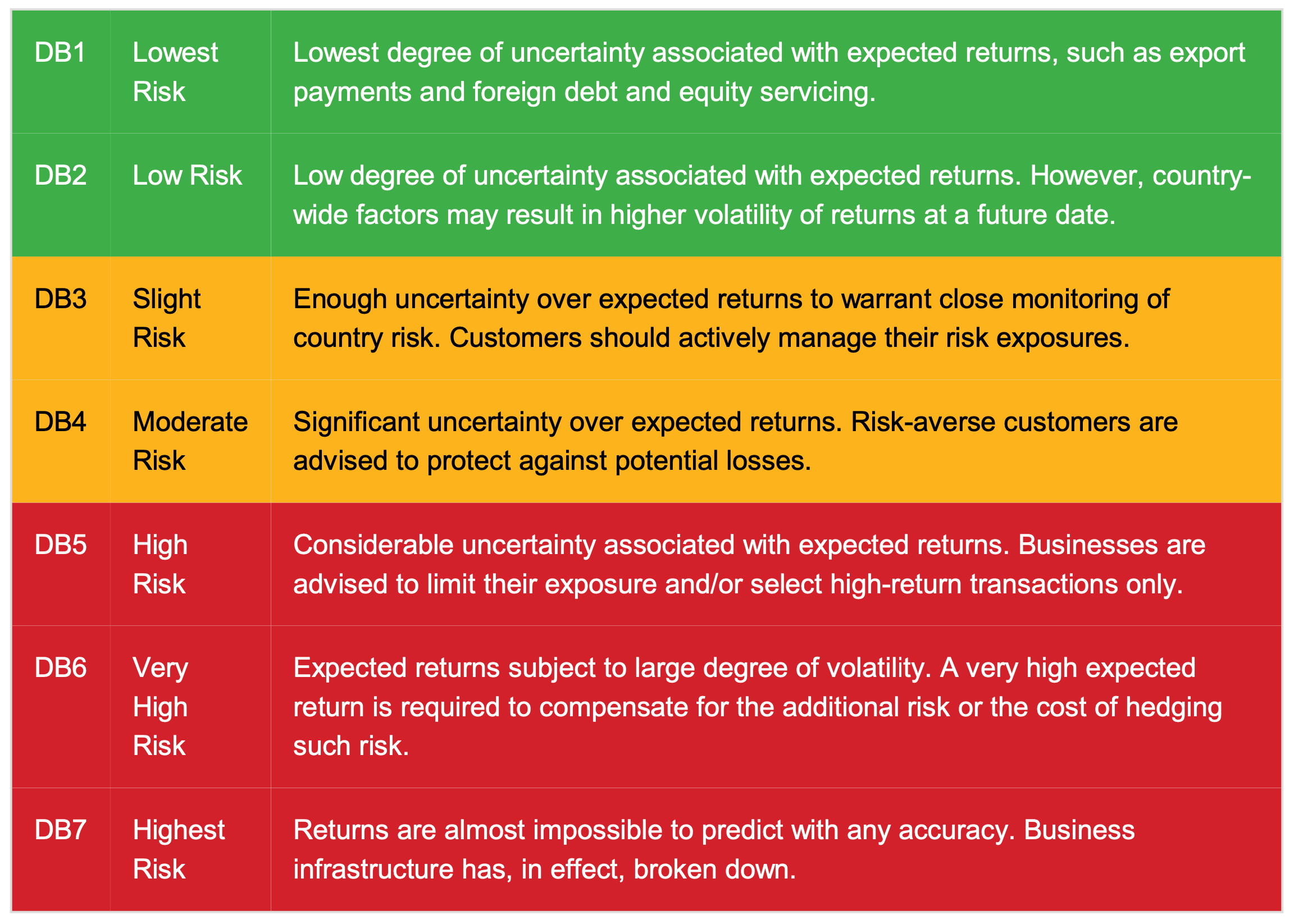

Dun & Bradstreet’s Country Risk Indicator provides a comparative, cross-border assessment of the risk of doing business in a country. The risk indicator is divided into seven bands, ranging from DB1 to DB7 – DB1 is lowest risk, DB7 is highest risk. Each band is subdivided into quartiles (a-d), with ‘a’ representing slightly less risk than ‘b’ (and so on). Only the DB7 indicator is not divided into quartiles.

The individual DB risk indicators denote the following degrees of risk:

Ratings and Outlook Changes:

Ratings changes:Changes in rating are made when we judge that there has been a significant alteration in a country’s overall circumstances – this could stem from a one-off event (e.g. a major natural disaster) or from a change in something structural/cyclical (e.g. an important shift in growth prospects). An upgrade indicates a significant change for the better, a downgrade a significant change for the worse. The number of quartiles of change indicates the extent of the improvement/deterioration in circumstances.

Outlook changes:The outlook trend indicates whether we think a country’s next rating change is likely to be a downgrade (‘Deteriorating’ trend) or an upgrade (‘Improving’ trend). A ‘Stable’ outlook trend indicates that we do not currently anticipate a rating change in the near future.

How Dun & Bradstreet can help

In addition to providing economic insights, Dun & Bradstreet offers a range of solutions that helps clients grow and thrive by empowering more intelligent actions that drive a competitive edge. Our data, insights and AI-driven platforms bring value to our clients both at departmental levels and across the organization.

Clients can access the Dun & Bradstreet Data Cloud directly for market-leading B2B data to fuel enterprise applications and workflows. Equally, clients can take advantage of our AI-driven SaaS solutions to gain a competitive edge within the areas of Sales and Marketing by identifying and engaging with the right targets- through modern, scalable solutions, and Finance and Risk to drive intelligent actions to manage credit-to-cash and third-party risk. Small Business owners use our solutions to help launch and manage their business. Dun & Bradstreet also works with agencies in every facet of government and the public sector – providing timely and critical information and insights that advance missions and help citizens thrive. More information is available at dnb.com

Legal and Copyright Notices

While the editors endeavor to ensure the accuracy of all information and data contained in this Country Insight Report, neither they nor Dun & Bradstreet Limited accepts responsibility for any loss or damage (whether direct or indirect) whatsoever to the customer or any third party resulting or arising therefrom.

© All rights reserved. No part of this publication may be reproduced or used in any form or by any means graphic, electronic or mechanical, including photocopying, recording, taping, or information storage and retrieval systems without permission of the publisher.

Disclaimer

Whilst Dun & Bradstreet attempts to ensure that the information provided in our country reports is as accurate and complete as possible, the quantity of detailed information used and the fact that some of the information (which cannot always be verified or validated) is supplied by third parties and sources not controlled by Dun & Bradstreet means that we cannot always guarantee the accuracy, completeness or originality of the information in some reports, and we are therefore not responsible for any errors or omissions in those reports. The recipients of these reports are responsible for determining whether the information contained therein is sufficient for use and shall use their own skill and judgment when choosing to rely upon the reports.