Country Risk and the Global Outlook

Country Risk and the Global Outlook

July 2020

To subscribe to the report, write to us at India@DNB.com

Signs of hope?

Commentary:

“The coronavirus pandemic is creating the biggest economic shock since 1929, easily eclipsing the most recent 2008-09 global financial crisis. Unsurprisingly, the impact of the global pandemic has again been the dominant theme in our monthly analytical output. Widespread quantitative easing means that financial asset prices globally are not reflecting the shock to fundamentals. But with many countries easing their lockdowns, a more varied picture of upgrades and downgrades has emerged. Worryingly, a sharp recession is still forecast, and we expect that the world economy will not attain pre-pandemic levels of activity before 2022. In India, the rising number of COVID-19 cases has led the country to become the 4th largest in terms of total number of reported cases. We expect India’s economy to contract this fiscal year after four decades of positive growth. In March, we downgraded India’s rating to DB5c from DB4d – both the magnitude of the downgrade and the risk level are the highest since 1994, said Dr Arun Singh, Chief Economist, Dun & Bradstreet.”

INTRODUCTION

After several months where Dun & Bradstreet analysis (Country Insight) was dominated by a solid wall of ratings downgrades, our most recent cycle of reports has seen the emergence of some faint signs of hope for the future. These positive signs came in the form of outlook upgrades for 10 of the 132 countries we cover. Out of 10 countries, 5 were in the Western Europe region, 3 in the Americas, and 1 each in both Eastern Europe and Sub-Saharan Africa. Despite these pockets of positive news, though, there was also another cluster of ratings downgrades elsewhere – 8 in total: 3 in the Americas, 2 in Asia-Pacific, another 2 in Eastern Europe, and 1 in Sub-Saharan Africa.

The wider global context remains sombre, with coronanvirus still spreading and economic prospects looking poor. We are currently forecasting that the global economy will contract by 5.2% in 2020 – the biggest decline since the Second World War and a far stronger contraction than the 1.7% recorded in 2009 during the global financial crisis. Furthermore, unlike in 2009, all regions will experience a contraction. Indeed, our analysis predicts that the global economy will not reach pre-pandemic levels of activity again before 2022, even if economies that managed to contain the virus accelerate their divergence from those that failed to do so. Looking ahead, any recovery into 2021 (even without a second bout of the pandemic) is going to be curtailed by several factors. Foremost will be the presence of degrees of social distancing (despite the easing of lockdowns), higher levels of post-lockdown unemployment and poverty, and increased saving by those in employment. Another element for the future is that the productivity of urban space will suffer a prolonged negative shock as long as social distancing applies and people fear the coronavirus, whether or not countries have contained their epidemics, with consequences for commercial real estate, employment and credit quality.

RATINGS UPGRADES

-

Slovenia: Most business reopened as the government eased the lockdown.

RATINGS DOWNGRADES

- Brazil: Controversial coronavirus-related policies and rising unemployment. The country’s economy, which contracted by 1.5% q/q in Q1, is expected to post a steeper second-quarter decline, as quarantine measures were implemented in two full months (April and May) compared to just March in the first quarter. Measures adopted in March to slow the spread of coronavirus dealt severe blows to economic activity across sectors, except for essential services, driving up credit risk.

- Colombia: Severe macroeconomic shock caused by the coronavirus pandemic: the economy is now set to contract by 4.5% in 2020.

- Jamaica: GDP is forecast to contract by 4.0%; moreover, the government finances are set to be hit by the effects of Covid-19-related stimulus spending.

- Cambodia: Declining construction, tourism and exports are weighing on the outlook and the important garment sector is experiencing rapidly falling order inflow from the EU, UK and North America; this caused a downgrade by one quartile.

- Papua New Guinea: Given the overall impact of Covid-19 (which will lead to a slowdown of real GDP growth to 0.3% in 2020, down from a previous estimate of 3.3%), the overall risk rating was downgraded.

- Turkmenistan: Due to slumping Chinese demand and rising pressure on the country’s slowly depleting FX reserves, Turkmenistan’s rating was downgraded by one quartile, with a macroeconomic slowdown to 2.0% growth in 2020 also contributing to the decision.

- Uzbekistan: With industrial production, retail sales and exports (with China being a key market for Uzbek companies) all slowing in Q1, and with an even bigger drop anticipated for Q2, we downgraded the country risk rating.

- Uganda: Risk rating has been revised downwards as enhanced border controls impact adversely on supply-chain integrity, while tourism and international trade will feel a severe pandemic impact in 2020.

Monthly changes in country risk ratings and outlook trends

|

Dun & Bradstreet Country Risk Analysis |

|||

|

Country |

June 2020 |

July 2020 |

Change |

|

|

|||

|

Country Risk Rating Upgrades (risk level has improved) |

|||

|

Slovenia |

DB4a |

DB3c |

2 quartiles |

|

|

|||

|

Country Risk Rating Downgrades (risk level has deteriorated) |

|||

|

Brazil |

DB4c |

DB5a |

2 quartiles |

|

Cambodia |

DB6b |

DB6c |

1 quartile |

|

Colombia |

DB4a |

DB4b |

1 quartile |

|

Jamaica |

DB5a |

DB5b |

1 quartile |

|

Papua New Guinea |

DB5d |

DB6a |

1 quartile |

|

Turkmenistan |

DB6b |

DB6c |

1 quartile |

|

Uganda |

DB5b |

DB5c |

1 quartile |

|

Uzbekistan |

DB6b |

DB6c |

1 quartile |

|

|

|||

|

Outlook Trend Upgrades |

|||

|

Argentina |

Deteriorating Rapidly |

Deteriorating |

|

|

Canada |

Deteriorating |

Stable |

|

|

France |

Deteriorating |

Stable |

|

|

Italy |

Deteriorating Rapidly |

Stable |

|

|

Netherlands |

Deteriorating |

Stable |

|

|

Serbia |

Deteriorating Rapidly |

Deteriorating |

|

|

Sweden |

Deteriorating |

Stable |

|

|

Switzerland |

Deteriorating |

Stable |

|

|

Tunisia |

Deteriorating |

Stable |

|

|

United States of America |

Deteriorating |

Stable |

|

|

|

|||

|

Outlook Trend Downgrades |

|||

|

Lebanon |

Stable |

Deteriorating |

|

|

Paraguay |

Stable |

Deteriorating Rapidly |

|

REGIONAL SUMMARIES

Asia Pacific

New coronavirus scares in Beijing, and most states in India reporting rising cases in June, showed that the region – despite early successes – is unlikely to shake off the economic effects before the end of 2020. Only a narrow range of sectors, such as Taiwan Region’s technology exports, are enjoying Covid-19-related pandemic tailwinds.

North America

The sharp rebound of some macro indicators gives credence to thoughts of a V-shaped recovery in activity in both the US and Canada, but the reappearance and sudden uptick in Covid-19 cases in Texas, Florida, Arizona and South Carolina indicate that the virus is still a macroeconomic risk, with the potential to disrupt the recovery.

Europe (EU + Iceland, Norway and Switzerland)

Forward-looking indicators in some countries have started to recover somewhat as lockdown measures are gradually being phased out. As a consequence, Dun & Bradstreet has upgraded a limited amount of trend outlooks. That said, a full economic recovery is not expected until 2022 at least.

Latin America & Caribbean

The region will record its steepest recession since the Great Depression, as Latin America is the coronavirus pandemic’s new epicentre. Brazil’s fatality rate is the second-highest globally, behind the US. Mexico has the second-highest Covid-19 deaths in the region; peaks are not yet reached. Recovery is expected to take until 2021 to develop.

Eastern Europe & Central Asia

The gradual recovery of the oil price since late April is helping hydrocarbon-rich economies in the region. That said, prices are still significantly below their pre-crisis readings and Russia, the region’s most important economy, is still hit hard by Covid-19, reporting more than half a million cases.

Middle East & North Africa

Regional PMIs indicate that business activity in the region continues to fall month on month; albeit the rate of contraction eased somewhat in May. Lockdowns are easing across the region despite a surge in new cases, particularly in the oil-rich Gulf states, raising concerns about the possibility of renewed lockdowns to come.

Sub-Saharan Africa

Regional countries continue to seek support to counter the downturn caused by multilateral institutions’ policies to stop the spread of Covid-19. But private sector organisations have yet to respond to calls for debt assistance. According to the WHO, new cases and associated deaths continue to rise across the region.

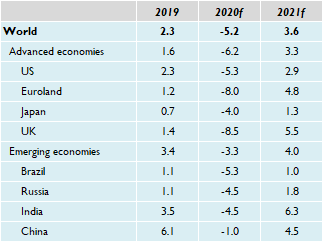

REAL GDP GROWTH (%)

Sources: IMF; JPMorgan; Dun & Bradstreet

Dun & Bradstreet Risk Indicator

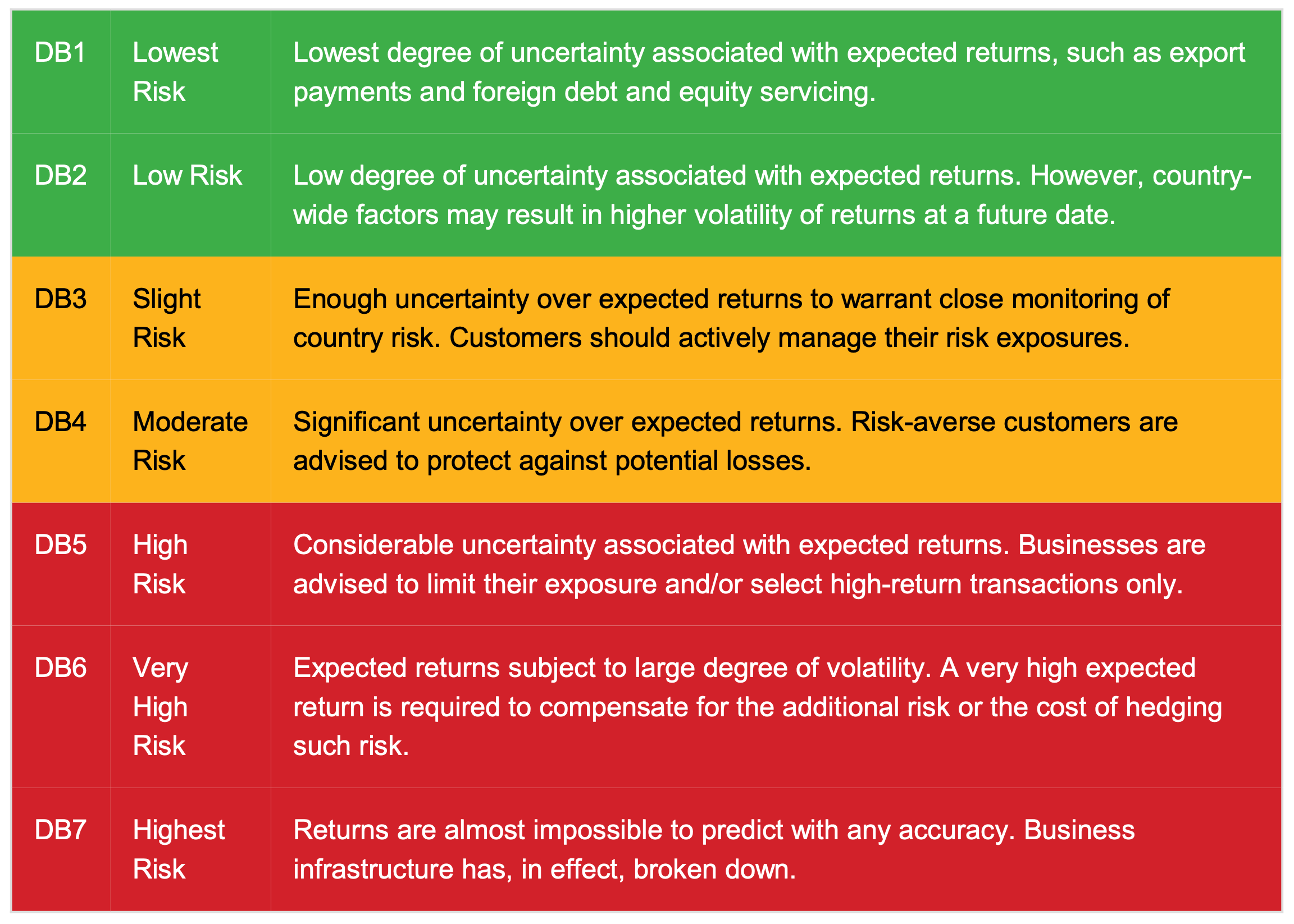

Dun & Bradstreet’s Country Risk Indicator provides a comparative, cross-border assessment of the risk of doing business in a country. The risk indicator is divided into seven bands, ranging from DB1 to DB7 – DB1 is lowest risk, DB7 is highest risk. Each band is subdivided into quartiles (a-d), with ‘a’ representing slightly less risk than ‘b’ (and so on). Only the DB7 indicator is not divided into quartiles.

The individual DB risk indicators denote the following degrees of risk:

Ratings and Outlook Changes:

Ratings changes: Changes in rating are made when we judge that there has been a significant alteration in a country’s overall circumstances – this could stem from a one-off event (e.g. a major natural disaster) or from a change in something structural/cyclical (e.g. an important shift in growth prospects). An upgrade indicates a significant change for the better, a downgrade a significant change for the worse. The number of quartiles of change indicates the extent of the improvement/deterioration in circumstances.

Outlook changes: The outlook trend indicates whether we think a country’s next rating change is likely to be a downgrade (‘Deteriorating’ trend) or an upgrade (‘Improving’ trend). A ‘Stable’ outlook trend indicates that we do not currently anticipate a rating change in the near future.

Legal and Copyright Notices

While the editors endeavour to ensure the accuracy of all information and data contained in this Country Insight Report, neither they nor Dun & Bradstreet Limited accept responsibility for any loss or damage (whether direct or indirect) whatsoever to the customer or any third party resulting or arising therefrom.

© All rights reserved. No part of this publication may be reproduced or used in any form or by any means graphic, electronic or mechanical, including photocopying, recording, taping, or information storage and retrieval systems without permission of the publisher.

Disclaimer

Whilst Dun & Bradstreet attempts to ensure that the information provided in our country reports is as accurate and complete as possible, the quantity of detailed information used and the fact that some of the information (which cannot always be verified or validated) is supplied by third parties and sources not controlled by Dun & Bradstreet means that we cannot always guarantee the accuracy, completeness or originality of the information in some reports, and we are therefore not responsible for any errors or omissions in those reports. The recipients of these reports are responsible for determining whether the information contained therein is sufficient for use and shall use their own skill and judgement when choosing to rely upon the reports.

To subscribe to the report, write to us at India@DNB.com