Dun & Bradstreet Business Optimism Index stands at 94.6, highest since Q2 2014

Highlights

- The Dun & Bradstreet Composite Business Optimism Index stands at 94.6 for Q4 2021, highest since Q2 2014. The index increased by 27.4% (q-o-q) in Q4 2021

- Optimism for volume of sales stands at 79%, highest in three quarters

- Optimism for new orders stands at 79%, highest since Q3 2014

- Optimism level for net profit stands at 62%, highest in three quarters

- Optimism for the level of inventory stands at 38%, lowest in three quarters

- Optimism for selling price stands at 49%, highest since Q2 2012

- Construction sector is the most optimistic on level of selling price, inventory levels and hiring of employees, while intermediate goods is the least optimistic on volume of sales, new orders, net profits, level of selling prices and hiring employees.

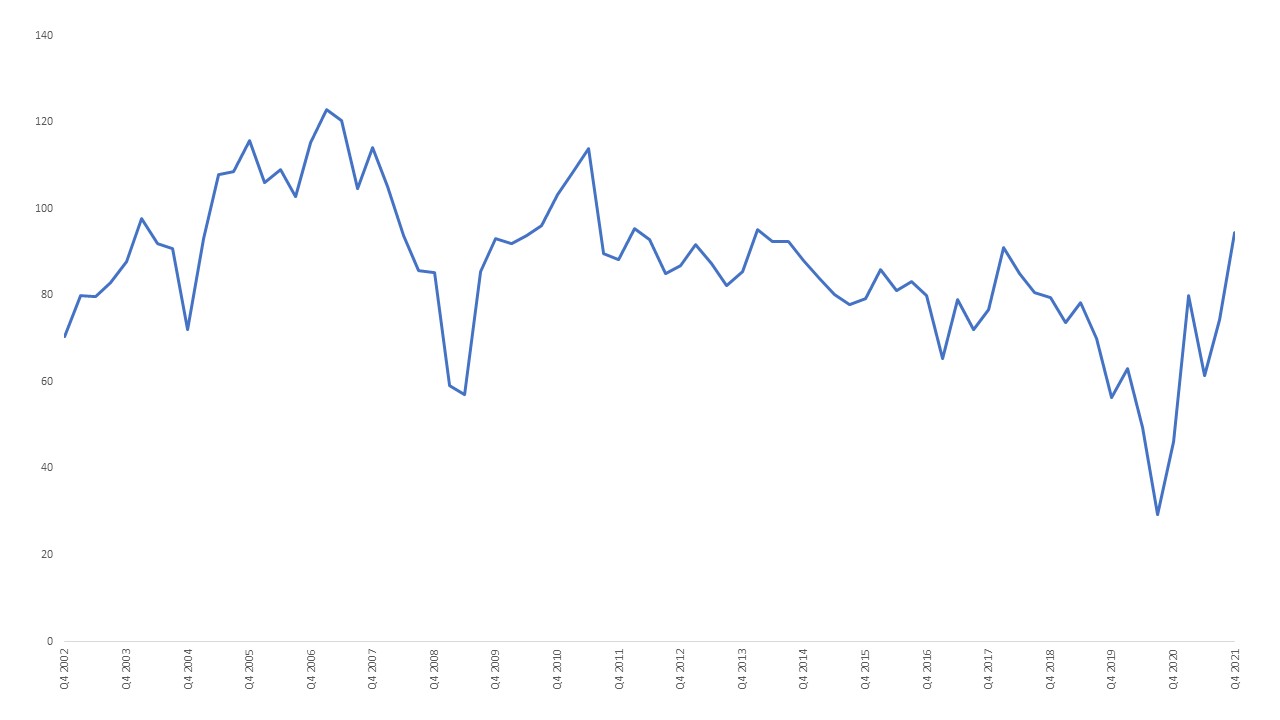

Mumbai, November 10, 2021: The Dun & Bradstreet Composite Business Optimism Index stands at 94.6 for Q4 2021, an increase of 27.4% compared to the Q3 2021 survey. Five out of six optimism indices have registered an increase as compared to Q3 2021. The Dun & Bradstreet Composite Business Optimism Index, which has been measuring the changing business sentiment of India Inc. since 2002, is a leading indicator for India’s overall growth with a correlation co-efficient of 80% with the Gross Domestic Product (GDP).

Dun & Bradstreet's Composite Business Optimism Index: Q4 2002 – Q4 2021

Note: BOI Index is for new base (2011)

"The GDP growth during October – December quarter of 2021 is likely to be strong as Dun & Bradstreet Business Optimism Index, the leading indicator of economic activity, has surged to an almost eight-year high. The government support in terms of accelerated vaccination drive, measures taken to increase FDI inflows, initiatives to boost the domestic manufacturing base along with facilitating investment clearances have been instrumental in driving the optimism level of businesses. The consumption boost to India Inc., from easing lockdown restrictions, pent up and festive demand, arrears payment of dearness allowances along with improving consumer confidence levels, are quite evident from the optimism for new orders which has climbed to the highest level since Q3 2014. Interestingly, optimism for hiring employees has risen to the highest in 10 years, signaling buoyant demand conditions as more people get back to jobs. Sustenance of the optimism level of businesses, however, depends on how effectively domestic supply challenges are managed and inflationary pressures are controlled. As prices in general are expected to go up driven by supply disruptions and rising commodity prices, both consumer spending and corporate earnings are at risk” said Arun Singh, Global Chief Economist, Dun & Bradstreet.

Key findings from the Q4 2021 survey

Around 79% of the respondents expect volume of sales to increase in Q4 2021, compared to 67% in Q3 2021, an increase of 12 percentage points. While around 15% expect it to remain unchanged, 6% expect the volume of sales to decline.

62% of the respondents expect an increase in net profits in Q4 2021, compared to 48% in Q3 2021, an increase of 14 percentage points. 30% expect net profits to remain unchanged, while 8% expect it to decrease.

44% of the respondents expect no change in the selling price of their products in Q4 2021. 49% of the respondents expect the selling price of their products to increase during Q4 2021, while 7% expect a decline.

79% of the respondents expect their order book position to improve in Q4 2021, compared to 57% in Q3 2021, an increase of 22 percentage points. While 20% of the respondents expect new orders to remain unchanged, only 1% anticipate new orders to decrease.

38% of the respondents expect their inventory level to increase during Q4 2021, compared to 42% in Q3 2021, a decrease of 4 percentage points. While another 48% anticipate no change in inventory level, 14% expect inventory level to decline.

49% of the respondents expect an increase in the size of their workforce employed during Q4 2021 compared to 36% in Q3 2021, an increase of 13 percentage points. While 45% anticipate no change in the number of employees, 6% expect their workforce size to decline.

About the Dun & Bradstreet Business Optimism Index

The Dun & Bradstreet Business Optimism Index is an indicator and measure of the pulse of the business community. The index is arrived at on the basis of a quarterly survey of business expectations.

The aforementioned survey is conducted on a sample of companies that are selected randomly from Dun & Bradstreet’s commercial credit file. The sample selected is a microcosmic representation of the country’s business community and includes companies from several sectors including basic goods, capital goods, intermediate goods, consumer durables, consumer non-durables and service sectors. All the respondents in the survey are asked six standard questions regarding their expectations as to whether the following critical parameters pertaining to their respective companies will register an increase, decline or show no change in the ensuing quarter as compared to the same quarter in the prior year: Volume of Sales, Net Profits, Selling Prices, New Orders, Inventories and Employees. The individual indices are then calculated by the percentage of respondents expecting an increase.

For calculating the Composite Business Optimism Index, each of the five parameters (excluding inventory) is assigned a weight. The positive responses for every parameter for the period under review are expressed as a proportion of positive responses in the base period (2011). The parameter weights are then applied to these ratios and the results aggregated to arrive at the Composite Business Optimism Index.