India’s Business Optimism highest in 11 years – Dun & Bradstreet Survey

India’s Business Optimism highest in 11 years – Dun & Bradstreet Survey

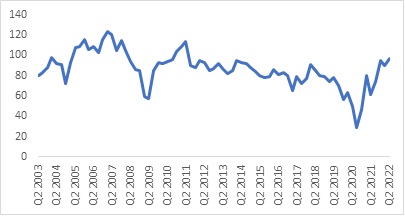

Mumbai, May 13, 2022: The Dun & Bradstreet Composite Business Optimism Index stands at 96.6 for Q2 2022, a rise of 7.4% compared to Q1 2022. All six of the six optimism indices have registered an increase, compared to Q1 2022. The Dun & Bradstreet Composite Business Optimism Index, which has been measuring the changing business sentiment of India Inc. since 2002, is a leading indicator for India’s overall growth with a correlation co-efficient of 80% with the Gross Domestic Product (GDP).

Highlights

- The Dun & Bradstreet Composite Business Optimism Index stands at 96.6 for Q2 2022. The index increased by 7.4 (q-o-q) in Q2 2022. On a y-o-y basis, it was up 57% and is the highest it has been since Q3 2011

- Optimism for selling prices stands at 52%, its highest level since Q2 2012

- Optimism for net profits stands at 65%, its highest level in five quarters

- Optimism for volume of sales stands at 76%, an increase of three percentage points compared to Q1 2022

- Optimism for new orders stands at 72%, an increase of three percentage points compared to Q1 2022

- Optimism for size of the workforce is the highest in 11 years

- The basic goods sector is the most optimistic about net profit and increasing workforce size

Dun & Bradstreet's Composite Business Optimism Index: Q2 2003 – Q2 2022

Note: BOI Index is for new base (2011)

Arun Singh, Global Chief Economist, Dun & Bradstreet said: “Amidst current heightened geopolitical uncertainty, optimism of firms in India in Q2 2022 surged to the highest level in 11 years, as recorded by our index. Resumption of business activity has gathered pace following the the third COVID wave experienced in India, with mobility increasing to above pre-COVID levels.”

He continued: “Both GST collections and exports growth were at an all-time high in March 2022 when the survey was conducted. Demand also remained resilient and E-way bills surged to 48-month high. Contrary to expectations that firm-level profitability would be negatively impacted by geo-political risk, our survey reveals that firms are confident they will record strong profits. Optimism around net profit was at the highest level it’s been in five quarters. Firms are likely to hire at an increased pace as their optimism for hiring workforce is also at a 11-year high, reflecting the buoyancy of the economy.”

“Nonetheless, risk remains elevated. Optimism for selling price is the highest since Q2 2012 indicating that retail prices will gain further momentum. The protracted geopolitical tension and the sanctions on Russia, in addition to already existing supply chain disruptions, are likely to set back global growth recovery, and might temper future business optimism levels,” Singh concluded.

Key findings from the Q2 2022 survey:

- Around 76% of the respondents expect volume of sales to increase in Q2 2022, compared to 73% in Q1 2022, an increase of three percentage points. While around 19% expect them to remain unchanged, 5% expect the volume of sales to decline.

- 65% of the respondents expect an increase in net profits in Q2 2022, compared to 62% in Q1 2022. 24% expect net profits to remain unchanged, while 11% expect them to decrease.

- 41% of the respondents expect no change in the selling price of their products in Q2 2022. 52% of the respondents expect the selling price of their products to increase during Q2 2022, while 7% expect a decline.

- 72% of the respondents expect their order book position to improve in Q2 2022, compared to 69% in Q1 2022, an increase of 3 percentage points. While 22% of the respondents expect new orders to remain unchanged, only 6% anticipate new orders to decrease.

- 40% of the respondents expect their inventory level to increase during Q2 2022, compared to 37% in Q1 2022, an increase of 3 percentage point. While 46% anticipate no change in inventory level, 14% expect inventory level to decline.

- 56% of the respondents expect an increase in the size of their workforce employed during Q2 2022, which is 7 percentage points higher than Q1 2022. While 39% anticipate no change in the number of employees, 5% expect their workforce size to decline.