Business Optimism Index Edges Higher in Q2 2025 Amid Domestic Demand Recovery

The Dun & Bradstreet Business Optimism Index increased by 5.1% (q-o-q) for Q2 2025

Mumbai, May 2, 2025: Dun & Bradstreet, a global leader in business decisioning data and analytics, released the Business Optimism Index (BOI) for Q2 2025, which rose to 120.2—marking a 5.1% increase over the previous quarter. The uptick reflects growing business confidence, particularly among small enterprises, driven by resilient domestic demand, improving macroeconomic fundamentals, and supportive policy measures. It is important to note that despite tariff-related uncertainty, optimism amongst companies has increased, reflecting businesses’ overall confidence in the domestic market.

Optimism in sales volumes and domestic orders rose steadily, particularly in food, beverages, metals, and transportation. Additionally, export order optimism saw an uptick from the previous quarter, likely due to businesses frontloading shipments ahead of the tariff changes announced on April 2, 2025. Sectors such as electronics, textiles, leathers, and metals were most optimistic across multiple indicators. ?

Rising import costs and escalating global trade tensions have increased input cost expectations among Indian businesses. In response to the prevailing uncertainty, firms are adopting leaner inventory strategies to mitigate potential risks. Despite these global headwinds, India’s macroeconomic resilience and policy agility provide a buffer, though sustaining business sentiment will depend on how effectively firms navigate global uncertainties and adapt to evolving global trade dynamics.

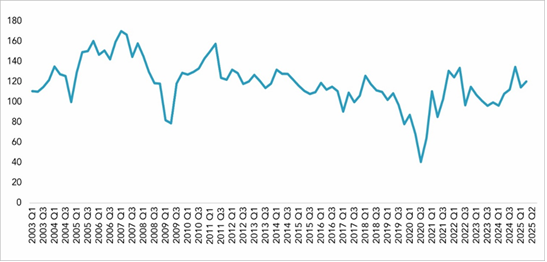

The Dun & Bradstreet Business Optimism Index, which has been tracking the changing business sentiment of India Inc. since 2002, continues to serve as a reliable leading indicator of India’s economic growth, maintaining a strong correlation of approximately 80% with the Gross Domestic Product (GDP).

Dun & Bradstreet Business Optimism Index

Arun Singh, Global Chief Economist, Dun & Bradstreet said, “The Dun & Bradstreet Business Optimism Index for Q2 2025 shows improved business confidence, driven by strong domestic demand, policy support, and accommodative monetary conditions. However, global challenges like geopolitical tensions and weak external demand weigh on sentiment. Export optimism seems tactical, tied to anticipated tariff changes, not a global demand revival. Input costs remain high due to expensive imports and supply issues, prompting firms to reduce inventories. Despite global risks, India’s strong domestic fundamentals and adaptive policies offer a competitive edge, especially as global supply chains shift.”

Key findings from the Q2 2025 survey

- The optimism for sales volume increased by 6 percentage points in Q2 2025 compared to the previous quarter Q1 2025. The food, beverages, metals, and transportation sectors are the most optimistic, while construction and information & communication sectors show lower optimism.

- The optimism for domestic orders rose by 2 percentage points in Q2 2025 compared to the previous quarter Q1 2025. The electricals, electronics, mining, textiles and leather sectors remain the most optimistic, while financial and insurance activities and automotive sectors report the lowest optimism.

- The optimism for export orders surged by 28 percentage points in Q2 2025 compared to the previous quarter Q1 2025. Electronics, metals, textile and leather sectors lead optimism, while financial and insurance activities and automotive sectors remain least optimistic.

- The optimism for selling prices increased by 2 percentage points in Q2 2025 compared to the previous quarter Q1 2025. The metals, hospitality, and food and beverages sectors show the highest optimism, while electronics and automotive sectors report lower confidence.

- The optimism for net profit improved by 6 percentage points in Q2 2025 compared to the previous quarter Q1 2025. The financial and insurance, construction, and hospitality sectors are the most optimistic, while electronics, automotive, and capital goods sectors show lower optimism.

- The optimism for the global macroeconomic environment increased by 10 percentage points in Q2 2025 compared to the previous quarter Q1 2025. The chemicals sector, along with utilities and professional and administrative services, remain most optimistic, while automotive and hospitality sectors show lower confidence.

- The optimism for employment remained stable, rising by 1 percentage point in Q2 2025 compared to the previous quarter Q1 2025. The hospitality, food & beverages, and textiles sectors exhibit high optimism, while automotive, transportation, and capital goods sectors show lower optimism.

- The optimism for the domestic macroeconomic environment declined by 3 percentage points in Q2 2025 compared to the previous quarter Q1 2025. The information & communication, financial services, wholesale & retail trade, and transportation sectors show the highest confidence, while hospitality and capital goods sectors are least optimistic.

- The optimism for input costs increased by 15 percentage points in Q2 2025 compared to the previous quarter Q1 2025. The metals, food and beverages sectors show higher optimism, while information & communication and financial services sectors report lower optimism

- The optimism for inventory levels saw a decline of 34 percentage points in Q2 2025 compared to the previous quarter Q1 2025. The Mining and automotive sectors are the most optimistic, while metals and food and beverages sectors report the lowest optimism.